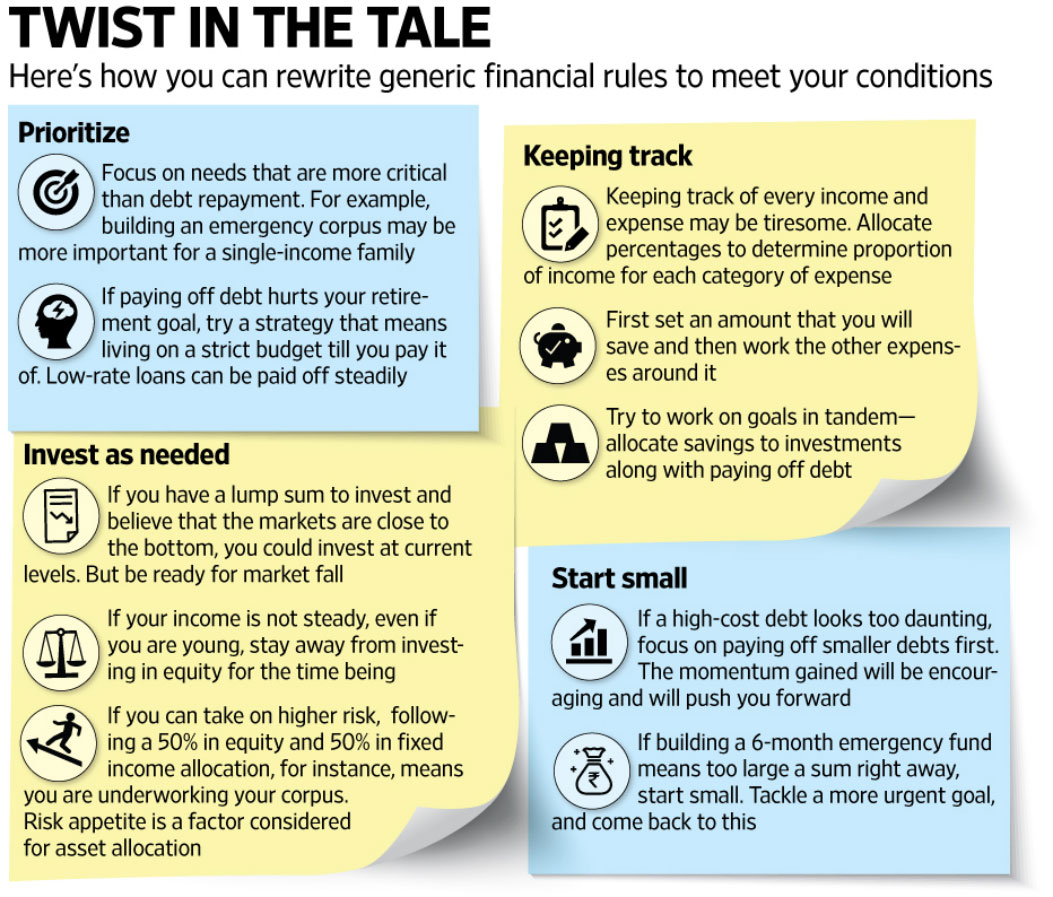

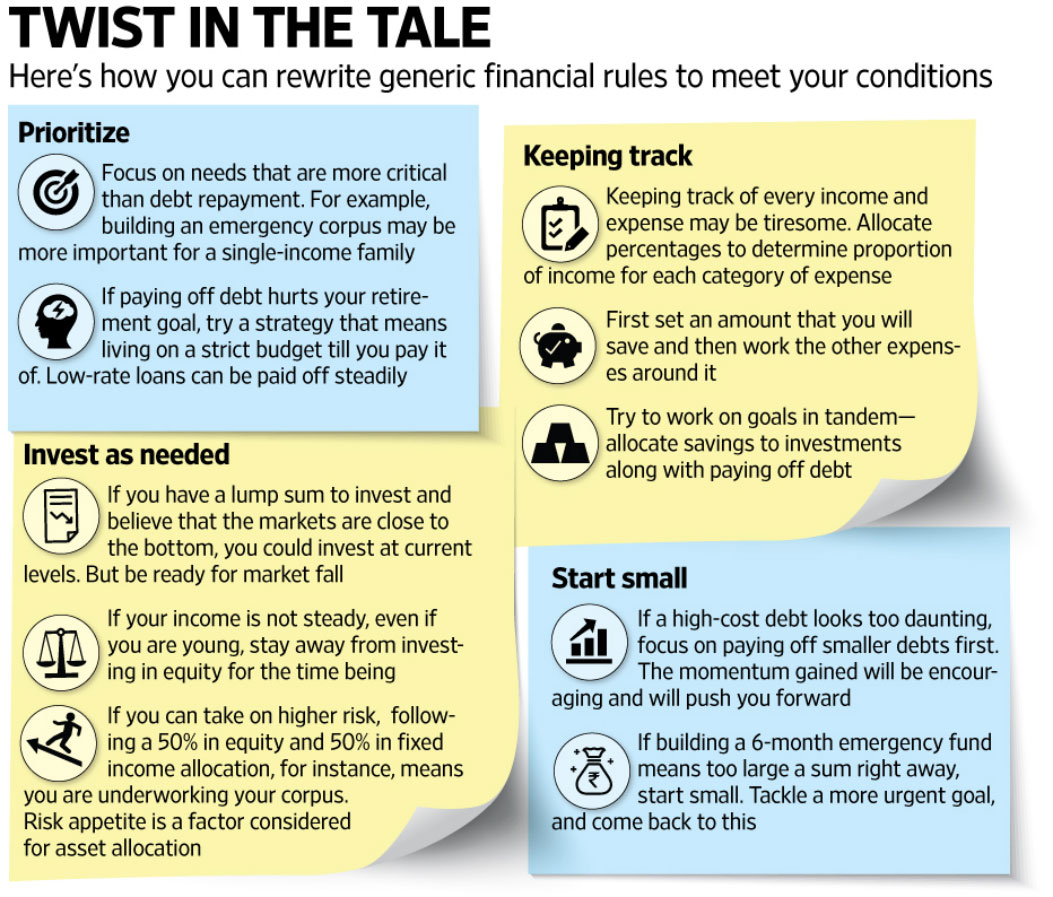

Financial rules are generic in nature and may not apply in all conditions. Take the rules and adapt them to your situation to get the best out of your money

There are rules prescribed to help you save, invest and reach your financial goals. But even the most diligent find it difficult to always live by the rules. Often this is because there isn’t any one-size-fits-all solution to financial problems. Here is a list of rules that you could rewrite when warranted. Doing so may help rather than hinder you on your financial path.

Pay off debt

Debt versus investments: Sometimes a singular focus on debt to the exclusion of all other financial needs may do you more harm than good. A better route would be to assess your specific financial situation and prioritize. For example, if you are a single-income family then an emergency fund is a primary protection need. If you are self-employed, then saving for retirement is very important. Build a plan that allows you to allocate savings to your investment priorities along with paying off debt. If possible, find more savings and consider a second income.

High-cost debt: When a large portion of the outstanding debt is in high-cost debt, say, a credit card balance, it can take a long time to wipe it off the books, and the amount may seem daunting. This can be a downer for people who are motivated by seeing results. For such people, a more sustainable debt-reduction plan would be one where the smaller debt, in terms of value, is tackled first. As each item of debt is crossed off the outstanding list, the momentum to stay the course and pay off the rest builds up leading to a greater chance of success.

Debt-free retirement: If you draw on your retirement corpus to pay off debt, you may be compromising the income you will have in retirement. Instead, have a plan that includes living on a strict budget till you pay it off. You could also find a job in retirement that will help service the debt. If the debt has a fixed low rate of interest, then it becomes easier to service. Similarly, debt that has tax benefits such as home loans and student loans have lower effective costs.

Invest in installments

In a rising market, investing in tranches leads to higher cost of acquisition. If you are investing through a route like a systematic investment plan (SIP), this high cost may get off set when markets are down. But what if you invest in lump sum? If you have a lump sum to invest and believe that the markets are close to the bottom, then it may make sense to invest at current levels. But make that decision only if you are willing to take the risk of a possible fall in prices after you have invested before they start rising again.

Income, expense details

If the time and effort involved in listing and tracking every item of expense is what is keeping you away from a budget and a more disciplined approach to income and expenses, then it may be worth looking for another way. One such approach would be to use percentages instead of absolute numbers to determine what proportion of the income would be allocated to each category of expense. Use your own experience to determine the percentage allocations to different broad heads of expenses such as housing, food, transportation and the like. But do remember to make the first allocation to savings and then work the other expenses around it.

6-month emergency fund

The trade-off for the security a 6-month emergency fund gives you is that a large sum of money will be invested in such a way that it earns a much lower return than what it otherwise could since the emergency fund is typically held in low-risk liquid investments. Plus, if building this corpus is your immediate priority, in the time that it takes you to build this 6-month corpus, your other goals are ignored. If the total amount or the time frame seems daunting, aim for a smaller number. After some time, or after having tackled a more urgent goal, you can come back to the emergency corpus and make it bigger. Also, in some circumstances, a smaller emergency fund may suffice. For example, if it’s a household with two comparable regular incomes, high job security and a low level of debt. If you qualify, then it frees up your saving to catch up on other goals.

Asset allocation rules

Broad asset allocation rules prescribed do not apply to specific situations. For example, one rule is that 100 or 120 minus your age is the percentage of equity exposure that your portfolio should have. This also gives a younger investor greater exposure to equity. But if your income has not stabilized then growth investments like equity may not be suitable. Or, if you follow a 50% in equity and 50% in fixed income allocation, it may mean that you are underworking your corpus when you are in the situation to take higher risks for better returns. Financial rules are tried and tested approaches to managing money. Recast them to your situation so that you are able to take the best decisions for your finances.

Source:livemint.com

There are rules prescribed to help you save, invest and reach your financial goals. But even the most diligent find it difficult to always live by the rules. Often this is because there isn’t any one-size-fits-all solution to financial problems. Here is a list of rules that you could rewrite when warranted. Doing so may help rather than hinder you on your financial path.

Pay off debt

Debt versus investments: Sometimes a singular focus on debt to the exclusion of all other financial needs may do you more harm than good. A better route would be to assess your specific financial situation and prioritize. For example, if you are a single-income family then an emergency fund is a primary protection need. If you are self-employed, then saving for retirement is very important. Build a plan that allows you to allocate savings to your investment priorities along with paying off debt. If possible, find more savings and consider a second income.

High-cost debt: When a large portion of the outstanding debt is in high-cost debt, say, a credit card balance, it can take a long time to wipe it off the books, and the amount may seem daunting. This can be a downer for people who are motivated by seeing results. For such people, a more sustainable debt-reduction plan would be one where the smaller debt, in terms of value, is tackled first. As each item of debt is crossed off the outstanding list, the momentum to stay the course and pay off the rest builds up leading to a greater chance of success.

Debt-free retirement: If you draw on your retirement corpus to pay off debt, you may be compromising the income you will have in retirement. Instead, have a plan that includes living on a strict budget till you pay it off. You could also find a job in retirement that will help service the debt. If the debt has a fixed low rate of interest, then it becomes easier to service. Similarly, debt that has tax benefits such as home loans and student loans have lower effective costs.

Invest in installments

In a rising market, investing in tranches leads to higher cost of acquisition. If you are investing through a route like a systematic investment plan (SIP), this high cost may get off set when markets are down. But what if you invest in lump sum? If you have a lump sum to invest and believe that the markets are close to the bottom, then it may make sense to invest at current levels. But make that decision only if you are willing to take the risk of a possible fall in prices after you have invested before they start rising again.

Income, expense details

If the time and effort involved in listing and tracking every item of expense is what is keeping you away from a budget and a more disciplined approach to income and expenses, then it may be worth looking for another way. One such approach would be to use percentages instead of absolute numbers to determine what proportion of the income would be allocated to each category of expense. Use your own experience to determine the percentage allocations to different broad heads of expenses such as housing, food, transportation and the like. But do remember to make the first allocation to savings and then work the other expenses around it.

6-month emergency fund

The trade-off for the security a 6-month emergency fund gives you is that a large sum of money will be invested in such a way that it earns a much lower return than what it otherwise could since the emergency fund is typically held in low-risk liquid investments. Plus, if building this corpus is your immediate priority, in the time that it takes you to build this 6-month corpus, your other goals are ignored. If the total amount or the time frame seems daunting, aim for a smaller number. After some time, or after having tackled a more urgent goal, you can come back to the emergency corpus and make it bigger. Also, in some circumstances, a smaller emergency fund may suffice. For example, if it’s a household with two comparable regular incomes, high job security and a low level of debt. If you qualify, then it frees up your saving to catch up on other goals.

Asset allocation rules

Broad asset allocation rules prescribed do not apply to specific situations. For example, one rule is that 100 or 120 minus your age is the percentage of equity exposure that your portfolio should have. This also gives a younger investor greater exposure to equity. But if your income has not stabilized then growth investments like equity may not be suitable. Or, if you follow a 50% in equity and 50% in fixed income allocation, it may mean that you are underworking your corpus when you are in the situation to take higher risks for better returns. Financial rules are tried and tested approaches to managing money. Recast them to your situation so that you are able to take the best decisions for your finances.

Source:livemint.com

Since the Union Budget was presented on February 1, 2018, there have been lots of reactions initially.

Since the Union Budget was presented on February 1, 2018, there have been lots of reactions initially, and then discussions on how to optimize the impact of long-term capital gains tax (LTCG) like SWP / booking profits up to LTCG of Rs.1 lakh per financial year. Now let us look at the worst case: you have crossed the threshold of Rs.1 lakh and now you have to pay LTCG tax. What is the impact on returns? We will discuss that now, but it is nothing to deter you from investing in equities.

The impact

The proper way to look at returns is compounded annualized growth rate (CAGR). The longer the period, on a CAGR basis, the impact of tax on your returns comes down, due to the compounding effect. Let us look at a few examples. Let’s say you invest Rs.100 in equity now, i.e., after February 1, 2018, to not complicate things with the grandfathering clause. After two years, your Rs.100 grows to Rs.121. This implies a CAGR of 10% pre-tax. The tax rate is 10% plus 4% cess, i.e., 10.4%. We are taking the tax rate at 10.4%, which is the worst-case scenario, after exhausting the limit of Rs.1 lakh. On the gain of Rs.121 – Rs.100 = Rs.21, at 10.4%, the LTCG tax incidence is Rs.2.18. On the net-of-tax return of Rs.18.82, the CAGR return is 9%. Hence the impact of the tax of 10.4% on return is 1% in CAGR terms. The point here is, equity is meant for long term and not just two years. Now let’s say Rs.100 grows to Rs.161.05 over five years. The CAGR returns, pre-tax, is 10%, same as the previous example. Tax incidence at 10.4% is Rs.6.35. On the return of Rs.54.7, the CAGR rate is 9.12%. Hence the impact on return is 10% – 9.12% = 0.88%, lower than 1% over a holding period of two years. From five years, let’s move on to 10 years. Rs.100 grows to Rs.259.37. The pre-tax CAGR is 10%. Net of tax at 10.4%, return is Rs.142.8. Net CAGR return is 9.28%, i.e., impact of tax on return is 10% – 9.28% = 0.72%. Progressively, over a longer holding period, the impact comes down from 1% to 0.88% to 0.72%, since the tax is payable only when you sell the shares and book profits whereas your money compounds over the years without any tax incidence.

Perspective

On the salary we receive, at the highest bracket, we have to pay tax at 30% plus surcharge and cess. On goods and services, depending on the item, GST ranges from nil to 28%. The one objection that remains on equity LTCG is that there is no indexation benefit. Indexation is available on debt mutual funds over a holding period of three years and real estate over a holding period of two years. The tax rate also is higher at 20.8%. Given the holding period and tax rate, 10.4% over one year is not that unfair. And who knows, sometime in future the government may increase the tax rate on equities, increase the holding period and give the benefit of indexation.

Conclusion

Every investment is subject to tax. Equity long term was exempt, which has been brought into the tax net now. The only ‘anomaly’ that remains, i.e. Investment without taxation, is unit-linked insurance plans (ULIPs). It is not advisable to go for any investment based on taxation only; it should be based on merits. Every investment has its own fundamental pros and cons and suitability aspects. If you are convinced that ULIPs are fundamentally better / suitable for you, then go for it. Otherwise, giving up less than 1% of your return should not be a deterrent for equities.

Source:financialexpress.com

Since the Union Budget was presented on February 1, 2018, there have been lots of reactions initially, and then discussions on how to optimize the impact of long-term capital gains tax (LTCG) like SWP / booking profits up to LTCG of Rs.1 lakh per financial year. Now let us look at the worst case: you have crossed the threshold of Rs.1 lakh and now you have to pay LTCG tax. What is the impact on returns? We will discuss that now, but it is nothing to deter you from investing in equities.

The impact

The proper way to look at returns is compounded annualized growth rate (CAGR). The longer the period, on a CAGR basis, the impact of tax on your returns comes down, due to the compounding effect. Let us look at a few examples. Let’s say you invest Rs.100 in equity now, i.e., after February 1, 2018, to not complicate things with the grandfathering clause. After two years, your Rs.100 grows to Rs.121. This implies a CAGR of 10% pre-tax. The tax rate is 10% plus 4% cess, i.e., 10.4%. We are taking the tax rate at 10.4%, which is the worst-case scenario, after exhausting the limit of Rs.1 lakh. On the gain of Rs.121 – Rs.100 = Rs.21, at 10.4%, the LTCG tax incidence is Rs.2.18. On the net-of-tax return of Rs.18.82, the CAGR return is 9%. Hence the impact of the tax of 10.4% on return is 1% in CAGR terms. The point here is, equity is meant for long term and not just two years. Now let’s say Rs.100 grows to Rs.161.05 over five years. The CAGR returns, pre-tax, is 10%, same as the previous example. Tax incidence at 10.4% is Rs.6.35. On the return of Rs.54.7, the CAGR rate is 9.12%. Hence the impact on return is 10% – 9.12% = 0.88%, lower than 1% over a holding period of two years. From five years, let’s move on to 10 years. Rs.100 grows to Rs.259.37. The pre-tax CAGR is 10%. Net of tax at 10.4%, return is Rs.142.8. Net CAGR return is 9.28%, i.e., impact of tax on return is 10% – 9.28% = 0.72%. Progressively, over a longer holding period, the impact comes down from 1% to 0.88% to 0.72%, since the tax is payable only when you sell the shares and book profits whereas your money compounds over the years without any tax incidence.

Perspective

On the salary we receive, at the highest bracket, we have to pay tax at 30% plus surcharge and cess. On goods and services, depending on the item, GST ranges from nil to 28%. The one objection that remains on equity LTCG is that there is no indexation benefit. Indexation is available on debt mutual funds over a holding period of three years and real estate over a holding period of two years. The tax rate also is higher at 20.8%. Given the holding period and tax rate, 10.4% over one year is not that unfair. And who knows, sometime in future the government may increase the tax rate on equities, increase the holding period and give the benefit of indexation.

Conclusion

Every investment is subject to tax. Equity long term was exempt, which has been brought into the tax net now. The only ‘anomaly’ that remains, i.e. Investment without taxation, is unit-linked insurance plans (ULIPs). It is not advisable to go for any investment based on taxation only; it should be based on merits. Every investment has its own fundamental pros and cons and suitability aspects. If you are convinced that ULIPs are fundamentally better / suitable for you, then go for it. Otherwise, giving up less than 1% of your return should not be a deterrent for equities.

Source:financialexpress.com

Many time investors just sell or switch their mutual fund units, as they feel they have made decent profit. However, financial planners suggest investors do a basic check before undertaking selling or switching.

1. How has the scheme performed?

Many investors are disappointed if a scheme does not perform in line with their expectation. For example, some are under the myth that if a stock doubled in two years, they would expect even an equity mutual fund scheme to do so. Financial planners suggest not to look at the performance of a mutual fund scheme in isolation. They suggest investors compare performance with the benchmark to know if your scheme is underperforming or the entire market is on a losing spree. If your scheme consistently underperforms for more than a year or more, it is time an investor takes a deeper look. Check for changes in the fund management style, change of fund managers. If it does not improve and you are not satisfied with the reasons, it may be a time to exit it. But if you have not given enough time, hold on to it.

2. What change has happened in your asset allocation?

Many investors work on the principle of asset allocation to maximize returns and minimize risks. If you use this approach to manage your portfolio, it necessitates re-balancing at regular intervals. So, in a rising market, when the equity component goes up, you may have to sell equity mutual fund schemes and come to fixed income to keep your asset allocation constant and come back to original asset allocation.

3. Has the investment goal been met?

Many investors tag their investments to a specific goal when they invest in mutual fund schemes. For example, if you are saving in an equity-oriented fund for your child’s education, and you accumulate the corpus you need for this goal, before time, it makes sense to switch the equity investment to a low risk liquid or ultra-short term debt fund a year before reaching the goal. This will ensure that even if the equity markets were to fall, your investments would remain unaffected and you will be able to reach your goal.

4. What factors do you need to consider before selling your mutual fund units?

Consider the exit load if any, and the tax implications before you sell your mutual fund units. For example, equity funds generally have an exit load of 1%, if you exit before one year and short-term capital gains tax of 15%. Similarly, fixed income schemes will be subject to short term capital gains if you sell any time before three years. Weigh in the impact of these things on your returns before you sell your mutual fund.

Source: Economic Times

1. How has the scheme performed?

Many investors are disappointed if a scheme does not perform in line with their expectation. For example, some are under the myth that if a stock doubled in two years, they would expect even an equity mutual fund scheme to do so. Financial planners suggest not to look at the performance of a mutual fund scheme in isolation. They suggest investors compare performance with the benchmark to know if your scheme is underperforming or the entire market is on a losing spree. If your scheme consistently underperforms for more than a year or more, it is time an investor takes a deeper look. Check for changes in the fund management style, change of fund managers. If it does not improve and you are not satisfied with the reasons, it may be a time to exit it. But if you have not given enough time, hold on to it.

2. What change has happened in your asset allocation?

Many investors work on the principle of asset allocation to maximize returns and minimize risks. If you use this approach to manage your portfolio, it necessitates re-balancing at regular intervals. So, in a rising market, when the equity component goes up, you may have to sell equity mutual fund schemes and come to fixed income to keep your asset allocation constant and come back to original asset allocation.

3. Has the investment goal been met?

Many investors tag their investments to a specific goal when they invest in mutual fund schemes. For example, if you are saving in an equity-oriented fund for your child’s education, and you accumulate the corpus you need for this goal, before time, it makes sense to switch the equity investment to a low risk liquid or ultra-short term debt fund a year before reaching the goal. This will ensure that even if the equity markets were to fall, your investments would remain unaffected and you will be able to reach your goal.

4. What factors do you need to consider before selling your mutual fund units?

Consider the exit load if any, and the tax implications before you sell your mutual fund units. For example, equity funds generally have an exit load of 1%, if you exit before one year and short-term capital gains tax of 15%. Similarly, fixed income schemes will be subject to short term capital gains if you sell any time before three years. Weigh in the impact of these things on your returns before you sell your mutual fund.

Source: Economic Times

Investors should understand how schemes have performed during various market cycles managed by the fund manager

It’s a challenge to choose a mutual fund scheme. There is an endless list of checks necessary to be done before arriving at the one mutual fund scheme that meets your requirements and has potential to give decent returns. Below are the various checks to keep in mind while comparing mutual funds:

Know Your Fund House:

Choosing a fund house in which you have sufficient faith to invest your money in is important before zeroing in on a scheme of your choice. Investors look for fund houses which can take care of their investments and can manage their money well. Objectives set by fund houses help investors to meet their goals thus securing their future. If the objectives are not met, investors lose faith in the fund house. One needs to ascertain how schemes have performed during various market cycles managed by the fund manager. A good fund manager is not only important for the fund house but also for an investor.

Fund Philosophy: The next important check is to know the philosophy of the fund house. A set of guiding principles that in form and shape an individual’s investments decision-making-process is termed as the philosophy of the fund. The fund house’s investment philosophy plays an important role in determining the performance of its funds in different market conditions. The selection of the funds, investment decisions are directly dependent on the fund philosophy.

Charges And Fees: An Asset Management Company (AMC) that spends on the upkeep of a mutual fund is measured as the expense ratio of a fund. The fees of the advisor, record-keeping, legal expenses, accounting, auditing fees, etc. are what make up an expense ratio. Higher churning of portfolio leads to higher costs. It is an expense borne by the investor and is deducted from the investment. For example, if you have invested Rs.100 and the expense ratio of fund is 1.25, then your investment is Rs.98.75. Lower expense ratio means that higher amount is available for investment.

Transparency: In today’s world it is very important to maintain a good relationship with the customers and to maintain a good relationship, there has to be a high level of transparency. This holds true even for mutual funds, as all mutual funds disclose the stocks they buy. Asset management companies to disclose all commissions paid to distributors. So, when it comes to long term wealth generation that puts the investor first, it may make sense to invest in a fund which focuses on transparency and controlling costs - rather than investing in a typical high-cost mutual fund that consciously uses big ads to attract your money.

Performance: The last factor is return on investments. All the above factors are major drivers behind the performance of the funds. There are many other factors which have direct & indirect impact on performance of the funds; however, we have discussed the major factors above. Moreover, it is important to understand that the performance of the funds can change over a period of time (positively as well as negatively), however, it’s philosophy, ethics, investment strategy are the main pillars. Don’t just only compare the performance of the fund in isolation.

To conclude, sound knowledge and research is very important before choosing a mutual fund to park your hard-earned money. Following all the above steps might help you take right decision. However, you must consult your financial advisor before taking any investment related decision.

Source: financialexpress.com

Know Your Fund House:

Choosing a fund house in which you have sufficient faith to invest your money in is important before zeroing in on a scheme of your choice. Investors look for fund houses which can take care of their investments and can manage their money well. Objectives set by fund houses help investors to meet their goals thus securing their future. If the objectives are not met, investors lose faith in the fund house. One needs to ascertain how schemes have performed during various market cycles managed by the fund manager. A good fund manager is not only important for the fund house but also for an investor.

Fund Philosophy: The next important check is to know the philosophy of the fund house. A set of guiding principles that in form and shape an individual’s investments decision-making-process is termed as the philosophy of the fund. The fund house’s investment philosophy plays an important role in determining the performance of its funds in different market conditions. The selection of the funds, investment decisions are directly dependent on the fund philosophy.

Charges And Fees: An Asset Management Company (AMC) that spends on the upkeep of a mutual fund is measured as the expense ratio of a fund. The fees of the advisor, record-keeping, legal expenses, accounting, auditing fees, etc. are what make up an expense ratio. Higher churning of portfolio leads to higher costs. It is an expense borne by the investor and is deducted from the investment. For example, if you have invested Rs.100 and the expense ratio of fund is 1.25, then your investment is Rs.98.75. Lower expense ratio means that higher amount is available for investment.

Transparency: In today’s world it is very important to maintain a good relationship with the customers and to maintain a good relationship, there has to be a high level of transparency. This holds true even for mutual funds, as all mutual funds disclose the stocks they buy. Asset management companies to disclose all commissions paid to distributors. So, when it comes to long term wealth generation that puts the investor first, it may make sense to invest in a fund which focuses on transparency and controlling costs - rather than investing in a typical high-cost mutual fund that consciously uses big ads to attract your money.

Performance: The last factor is return on investments. All the above factors are major drivers behind the performance of the funds. There are many other factors which have direct & indirect impact on performance of the funds; however, we have discussed the major factors above. Moreover, it is important to understand that the performance of the funds can change over a period of time (positively as well as negatively), however, it’s philosophy, ethics, investment strategy are the main pillars. Don’t just only compare the performance of the fund in isolation.

To conclude, sound knowledge and research is very important before choosing a mutual fund to park your hard-earned money. Following all the above steps might help you take right decision. However, you must consult your financial advisor before taking any investment related decision.

Source: financialexpress.com

Please do not reply back to this mail. This is sent from an unattended mail box.

Please mark all your queries / responses to webmaster@ecrwealth.com.

Information provided on this newsletter has been independently obtained from sources believed to be reliable. However, such information may include inaccuracies, errors or omissions. www.ecrwealth.com and its affiliates, information providers or content providers, shall have no liability to you or third parties for the accuracy, completeness, timeliness or correct sequencing of information available on this newsletter, or for any decision made or action taken by you in reliance upon such information, or for the delay or interruption of such information. www.ecrwealth.com, its affiliates, information providers and content providers shall have no liability for investment decisions or other actions taken or made by you based on the information provided on this newsletter.