Topic 3: Where do people go wrong in mutual fund investing?

In April-May 2017, Mint surveyed 19 financial advisers to know some of the biggest mistakes investors make. Over the next few weeks, we spoke to more advisers about these mistakes. This week, we talk to Bharat Phatak, founder, and director of Wealth Managers (India) Pvt. Ltd.

Phatak said that he has observed that investors approached mutual fund investing looking at the “rear view mirror”.

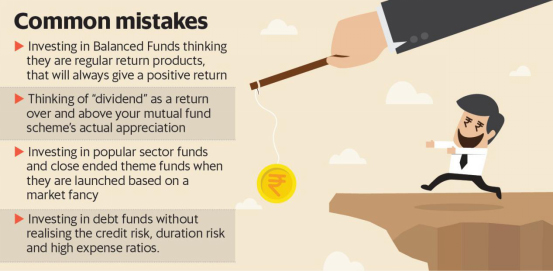

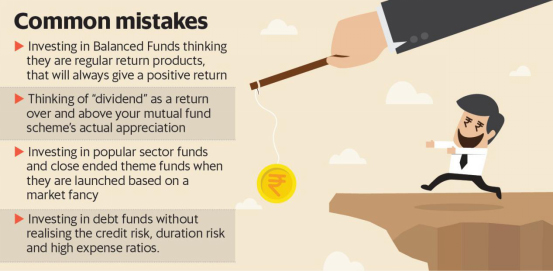

One example in recent times is balanced funds and how investors were drawn into them on the back of high dividends. In January 2018, Mint carried a story on how balanced funds were being mis-sold on the premise of high dividends that some of them were paying till that time. Budget 2018’s imposition of 10% dividend distribution tax on equity-oriented mutual funds has made dividend plans unattractive but there are some funds that still give a subtle assurance of dividends. “Some investors have this misconception that dividend is an extra return on your fund. However, when the dividend is declared, it comes out of your own funds and that reduces the net asset value,” said Phatak.

He added that when investors think that balanced funds are regular return products, there is a problem. “Balanced funds, like any other equity funds, can be volatile and no income is assured. It’s just that over a long period of time, chances to earn higher returns are there—with higher risks— but investors need to be patient,” he said.

Another way of investing looking in the rear view mirror is by investing in sector funds and closed-end funds. Although sector funds have gone down over time, closed-end funds have continued. But recently, the Securities and Exchange Board of India has told mutual funds that it will not approve of any such funds unless they are different from existing funds, even if existing funds are open-ended.

“This is a good move as investing in the popular sector and closed-end theme funds, when they are launched based on a market fancy, is a bad idea. Unless these funds offer something unique, it doesn’t make sense,” said Phatak.

Having started distributing mutual funds—especially debt funds—in as early as 1999, when dividends from debt and equity funds were made tax-free in the Budget, Phatak knows the importance of debt funds in an investor’s portfolio. This is also why he advocates caution in investing in debt funds, without understanding the risks that come along with them. “Debt funds are beneficial for investors. But understand credit risk, interest rate risk (how the movement of interest rates can impact your debt funds) and expense ratios. Debt funds are sensitive to high expense ratios also,” said Phatak.

He added: “In many cases, it may be too late to correct the mistakes as investors come to us after they have had a setback. However, what needs to be done is to avoid the mistakes in future and compounding existing problems. For this, it is essential to go back to the drawing board, decide the objectives for which the investments are being made and align the restructured portfolio to them.”

Source: livemint.com

Phatak said that he has observed that investors approached mutual fund investing looking at the “rear view mirror”.

One example in recent times is balanced funds and how investors were drawn into them on the back of high dividends. In January 2018, Mint carried a story on how balanced funds were being mis-sold on the premise of high dividends that some of them were paying till that time. Budget 2018’s imposition of 10% dividend distribution tax on equity-oriented mutual funds has made dividend plans unattractive but there are some funds that still give a subtle assurance of dividends. “Some investors have this misconception that dividend is an extra return on your fund. However, when the dividend is declared, it comes out of your own funds and that reduces the net asset value,” said Phatak.

He added that when investors think that balanced funds are regular return products, there is a problem. “Balanced funds, like any other equity funds, can be volatile and no income is assured. It’s just that over a long period of time, chances to earn higher returns are there—with higher risks— but investors need to be patient,” he said.

Another way of investing looking in the rear view mirror is by investing in sector funds and closed-end funds. Although sector funds have gone down over time, closed-end funds have continued. But recently, the Securities and Exchange Board of India has told mutual funds that it will not approve of any such funds unless they are different from existing funds, even if existing funds are open-ended.

“This is a good move as investing in the popular sector and closed-end theme funds, when they are launched based on a market fancy, is a bad idea. Unless these funds offer something unique, it doesn’t make sense,” said Phatak.

Having started distributing mutual funds—especially debt funds—in as early as 1999, when dividends from debt and equity funds were made tax-free in the Budget, Phatak knows the importance of debt funds in an investor’s portfolio. This is also why he advocates caution in investing in debt funds, without understanding the risks that come along with them. “Debt funds are beneficial for investors. But understand credit risk, interest rate risk (how the movement of interest rates can impact your debt funds) and expense ratios. Debt funds are sensitive to high expense ratios also,” said Phatak.

He added: “In many cases, it may be too late to correct the mistakes as investors come to us after they have had a setback. However, what needs to be done is to avoid the mistakes in future and compounding existing problems. For this, it is essential to go back to the drawing board, decide the objectives for which the investments are being made and align the restructured portfolio to them.”

Source: livemint.com