Topic 4: Systematic Withdrawal Plan: How to relish your post retirement life with the power of SWP of mutual funds

Systematic Withdrawal Plan: Retirement is a bitter truth of life which cannot be changed or ignored. People work hard in their pre-retirement period to amass a good amount before they reach the golden age in order to spend a worry-free post-retirement life. This process of gathering the capital is known as accumulation. The time when you actually retire and start collecting capital from various investments for utilization or allocation is the distribution phase.

Both the phases hold their importance in their own time, but distribution phase always has a stronger case. Two strong reasons to support this are — first, smart planning of the accumulated wealth at risk-free places and second, maintaining a regular cash flow to deal with the inflation-influenced expenses. The hardship is when you know you are not a government employee who has access to regular income in the form of pension.

So, how can you relish and spend a stress-free life after retirement? The optimum solution to this may be leveraging SWP or Systematic Withdrawal Plan provided by mutual funds.

SWP is an automatic withdrawal plan where a pre-determined amount can be withdrawn at regular intervals of time. These withdrawals let an investor cherish the same feeling as that of a pensioner receiving his pension.

What Procedure Is Required to Avail the Benefits of SWP?

Investors are required to first shift the accumulated amount to a low-risk investment fund, and then apply for an SWP plan for regular withdrawal. Most of the retired people prefer shifting their investments or collected corpus to safe options which include debt mutual funds, retirement plans, etc. On the other hand, some retirees who have the ability to endure high risk choose to shift their accumulated corpus in equity in order to pocket in higher returns and maintain a regular cash flow. Lastly, investors can decide the date and frequency of withdrawals.

Retirees, Why Not Harbor the Tax Advantage?

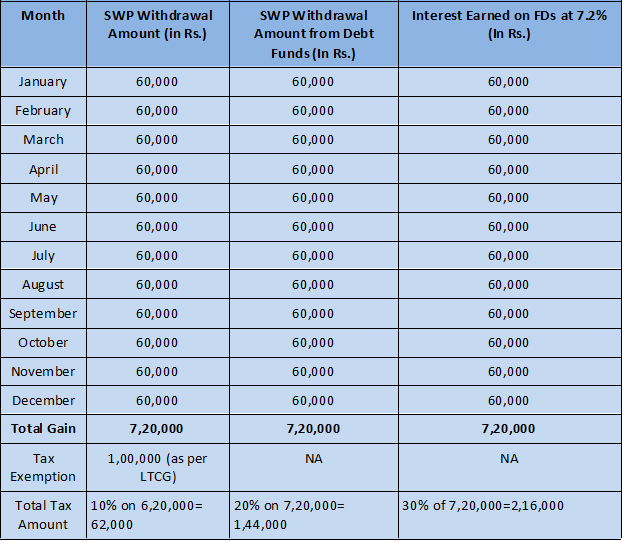

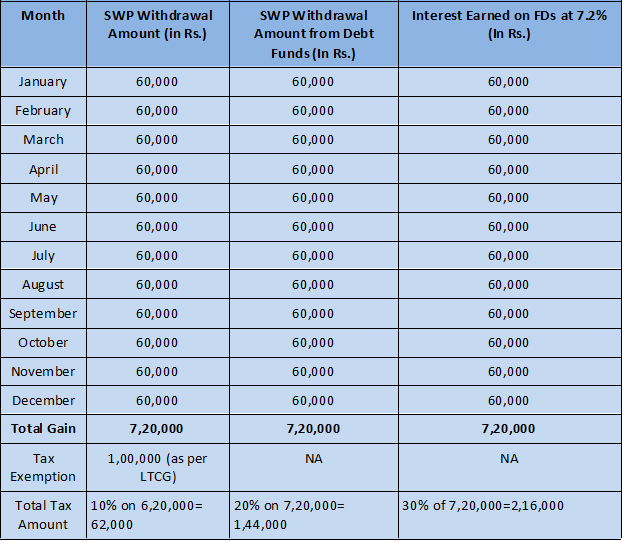

By now, we know that SWP is a reversal of SIP (Systematic Investment Plan) and since it is looked upon as redemption, it is also subjected to tax. To understand how tax calculations are carried in SWP, let us imagine a scenario wherein a retired official has accrued a corpus of Rs 1 crore with him, but he is not sure about how to put this money to work. What do you say will be a smart choice — Depositing the corpus in banks as FDs or Investing that corpus in equity funds or debt funds, and then implementing SWP? Let us reach a conclusion by performing the tax calculations. The calculation is done for one year on the corpus of Rs 1 Cr. The interest earned on FD is 7.2% (which makes monthly interest of Rs 60,000) and the withdrawal amount in SWP is kept Rs 60,000 per month from equity fund and debt funds. However, the average annual return on the remaining balance is assumed to be 12-15% in equity and 8%-10% in debt investments. This is an additional benefit on investments in equity and debt funds, but such benefits are not considered in the tax comparison.

SWP tax calculation on equity and debt funds v/s FDs:

# In debt funds, the STCG is applicable on redemption before 3 years, so we are assuming that the retired person implements SWP for the fourth year. Hence, the total tax on the capital gain is applied at 20%.

# Although for calculating the capital gain, we need to deduct the cost from the sale value, in the above example, we have ignored the cost deduction.

# LTCG on debt fund is calculated with Indexation benefit, but to simplify the calculations, we have ignored the indexation benefit as well. Analyzing the data in the table above, we can see that in order to save more tax, SWP is a better option to go with rather keeping the corpus in FDs.

What Is the Moral of the Story?

Retiring from work gives you dual feeling – one is the feeling of relief that says you do not have to work anymore and the other is of distress about not having to depend on anyone and still coping with the regular monthly expenses. To live an independent and respectful life and to stop worrying about the source of getting a regular income, one can choose to invest in mutual funds and start SWP then. Through SWP, you will not only have access to a regular fixed income but also your invested capital will earn interest on the same simultaneously. As they say, ‘tomorrow never comes, and if it comes, it never dies.’ So, one must never delay or procrastinate things for tomorrow. What if you are still in your 20s? You should not think it’s too early to plan for post-retirement corpus because you too will hit the retirement day and get the retirement treat from your junior employees.

Source: financialexpress.com

What Procedure Is Required to Avail the Benefits of SWP?

Investors are required to first shift the accumulated amount to a low-risk investment fund, and then apply for an SWP plan for regular withdrawal. Most of the retired people prefer shifting their investments or collected corpus to safe options which include debt mutual funds, retirement plans, etc. On the other hand, some retirees who have the ability to endure high risk choose to shift their accumulated corpus in equity in order to pocket in higher returns and maintain a regular cash flow. Lastly, investors can decide the date and frequency of withdrawals.

Retirees, Why Not Harbor the Tax Advantage?

By now, we know that SWP is a reversal of SIP (Systematic Investment Plan) and since it is looked upon as redemption, it is also subjected to tax. To understand how tax calculations are carried in SWP, let us imagine a scenario wherein a retired official has accrued a corpus of Rs 1 crore with him, but he is not sure about how to put this money to work. What do you say will be a smart choice — Depositing the corpus in banks as FDs or Investing that corpus in equity funds or debt funds, and then implementing SWP? Let us reach a conclusion by performing the tax calculations. The calculation is done for one year on the corpus of Rs 1 Cr. The interest earned on FD is 7.2% (which makes monthly interest of Rs 60,000) and the withdrawal amount in SWP is kept Rs 60,000 per month from equity fund and debt funds. However, the average annual return on the remaining balance is assumed to be 12-15% in equity and 8%-10% in debt investments. This is an additional benefit on investments in equity and debt funds, but such benefits are not considered in the tax comparison.

SWP tax calculation on equity and debt funds v/s FDs:

# In debt funds, the STCG is applicable on redemption before 3 years, so we are assuming that the retired person implements SWP for the fourth year. Hence, the total tax on the capital gain is applied at 20%.

# Although for calculating the capital gain, we need to deduct the cost from the sale value, in the above example, we have ignored the cost deduction.

# LTCG on debt fund is calculated with Indexation benefit, but to simplify the calculations, we have ignored the indexation benefit as well. Analyzing the data in the table above, we can see that in order to save more tax, SWP is a better option to go with rather keeping the corpus in FDs.

What Is the Moral of the Story?

Retiring from work gives you dual feeling – one is the feeling of relief that says you do not have to work anymore and the other is of distress about not having to depend on anyone and still coping with the regular monthly expenses. To live an independent and respectful life and to stop worrying about the source of getting a regular income, one can choose to invest in mutual funds and start SWP then. Through SWP, you will not only have access to a regular fixed income but also your invested capital will earn interest on the same simultaneously. As they say, ‘tomorrow never comes, and if it comes, it never dies.’ So, one must never delay or procrastinate things for tomorrow. What if you are still in your 20s? You should not think it’s too early to plan for post-retirement corpus because you too will hit the retirement day and get the retirement treat from your junior employees.

Source: financialexpress.com