After experiencing the booming stock market amid the crippled 2020 economy, many investors are experiencing the other side. Despite a growing

economy, the markets have turned treacherous.

The wild ride on the equity markets continued in May 2022, with the Nifty 50 sinking more than 1320 points by mid-May as investors worried about a

recession in the US, inflation, the war in Ukraine, and tighter monetary policies by major central banks across the globe. However, markets recovered in the

second half of the month, with the Nifty 50 losing 3% for the month. Post the market correction of over 10% after hitting a record high in October 2021, the

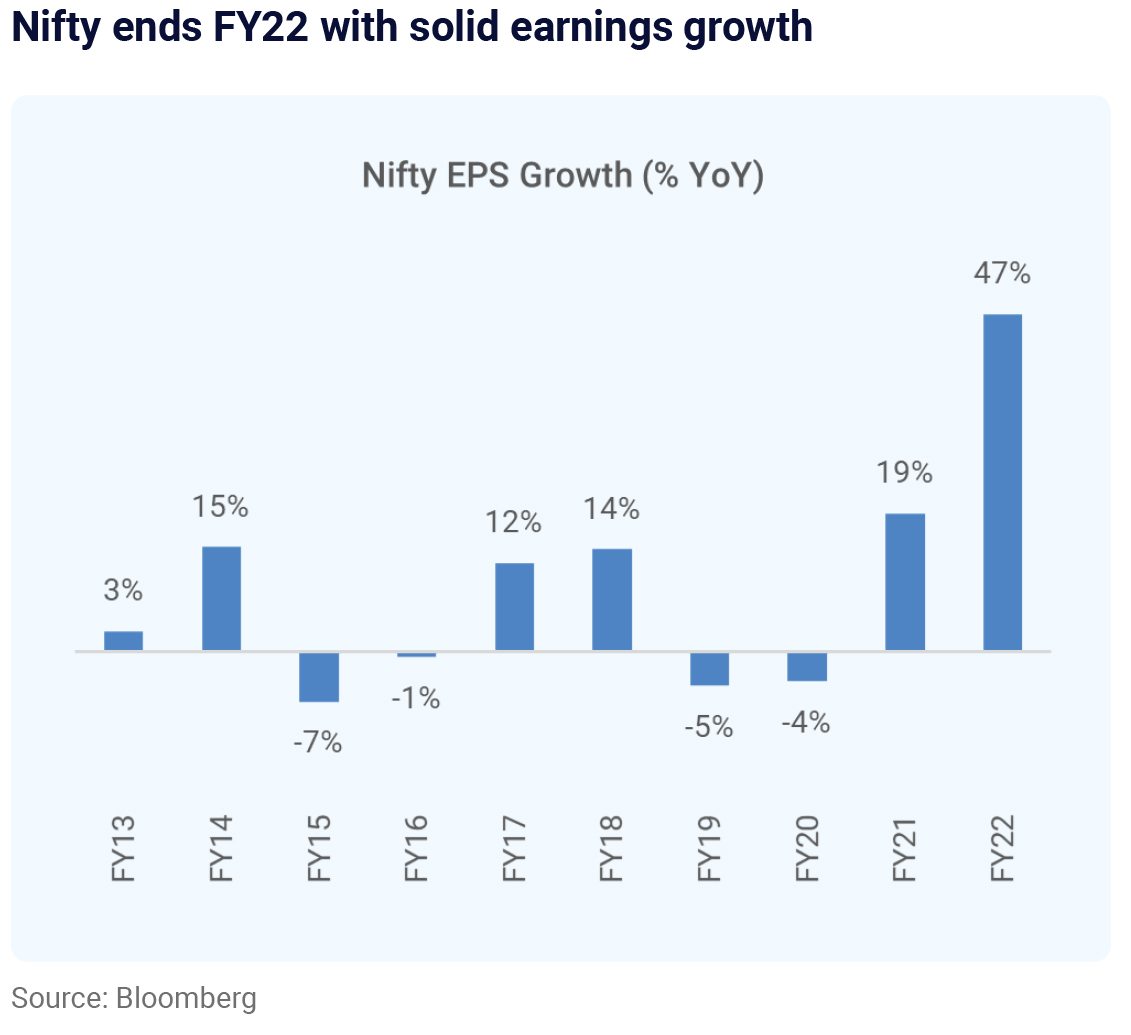

market valuation is near its long-term average. Markets may continue to remain volatile in the near term. However, as the dust settles, we believe the

fundamentals for equity markets in India are intact with steady growth in earnings. Overall earnings for Q4FY22 were in line with market expectations,

however, there was a wide divergence between sectors due to the rising raw material prices. Going forward, the full impact of rising raw material prices

could be felt in the first half of the current financial year.

Also, as India approaches a size of a $5 trillion economy over the coming years, the aggregate market capitalization of Indian companies shall grow by

10-12%, providing investors with ample opportunities to create wealth.